California utilities are going to attack the range anxiety impeding electric vehicle growth.

Following the December California Public Utilities Commission decision to allow utilities to invest in EV charging infrastructure, Pacific Gas and Electric Company (PG&E) trumped the state’s two other investor owned utilities by asking for regulatory approval of the biggest charging station build-out ever.

“California has the most electric vehicles in the U.S. and PG&E has over 60,000 electric vehicles in our service territory, the most in California and 20% of all U.S. EVs,” explained PG&E Director of Electrification/Electric Vehicles James Ellis. “But with 40% of California greenhouse gas emissions (GHGs) coming from the transportation sector, growth in EV infrastructure is not fast enough to drive adoption of the electric transportation needed to meet the state’s 80% GHG reduction by 2050 goal.”

PG&E wants CPUC approval to partner with the private sector to build 25,000 level two charging stations and 100 DC fast charging stations, which is about 25% of the infrastructure needed by 2020 in its Northern and Central California service territory.

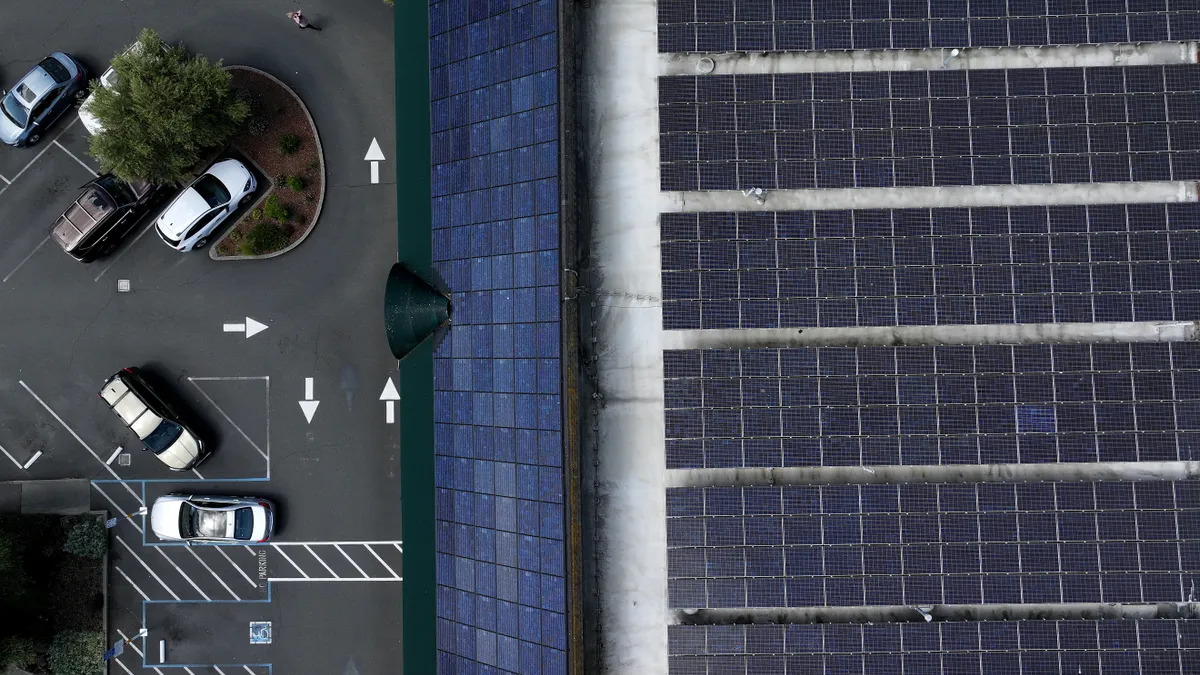

The 25,000 level two chargers, to be located at commercial and public sites like multi-family dwellings, retail centers, and workplaces, will provide up to 25 miles for every hour of charging. The 100 DC fast chargers, which fully recharge an EV’s battery in only 30 minutes, would be more dispersed.

Other IOU initiatives and costs to ratepayers

The program’s total cost of $653.8 million would be applied across the PG&E ratepayer base because the program supports state GHG and pollution reduction goals. Ratepayers would see no bill impact in 2016 and 2017, according to PG&E, and costs would reach only $0.001 per KWH over the next five years, adding an estimated $0.70 per month to the typical residential customer’s bill from 2018 to 2022.

The San Diego Gas & Electric (SDG&E) $103 million electric vehicle-grid integration (VGI) plan was designed to test customer response to variable rates for vehicle charging. It would build 5,500 charging stations, primarily at multi-family housing and workplaces, between 2015 and 2025. The capital cost would be approximately $59 million and operations and maintenance over the ten years would add $44 million.

The Southern California Edison (SCE) $355 million Charge Ready Programs would run five years, from 2015 through 2019, and result in a rate increase of $0.001 per KWH, or 0.1% to 0.3% of the average bill. Phase 1, a one-year pilot, would cost $22 million and deploy up to 1,500 charging stations. Phase 2 would cost an additional $333 million and deploy up to 30,000 charging stations by 2020. SCE would locate, design, build, own, and maintain the electrical infrastructure. Customers would choose, own, operate, and maintain the charging stations.

Both an Administrative Law Judge and The Utility Reform Network (TURN) customer advocate expressed concern about rate impacts from SDG&E’s VGI. This suggests the utility proposals may face serious scrutiny before winning regulatory approvals.

Why utilities should be involved

“Plug-in America very much supports the utilities becoming involved,” said Plug-in America Director Jay Friedland. “But the devil is in the details. We will be watching to make sure they are installing the right infrastructure in the right places and serving the needs of electric vehicle drivers.”

The CPUC seems aware, in reversing its 2011 decision prohibiting utilities from building EV charging infrastructure, that it must “make sure the infrastructure is going into the ground and into the ground in the right places,” Friedland added.

Government subsidies for charging infrastructure are typically workable only at the local level because municipalities know their transportation systems, Friedland explained. The private sector has been significantly more successful.

“An owner who goes to a Tesla super charging station knows there will be 4 or 8 or even 12 chargers,” he said. Other automakers are moving in that direction, as exemplified by a new BMW-Volkswagen plan. Private charger manufacturers like ChargePoint have also built infrastructure.

“The third model is utilities,” Friedland said. “So far, only NRG Energy has jumped in but that is the beginning of the utility model.”

The infrastructure

If California is to meet Gov. Brown’s 2013 goal of having 1.5 million zero emissions vehicles (ZEVs) by 2025, Ellis said, it will have about 1 million in 2020 and PG&E’s 40% will be 400,000 of those, Ellis said. Based on research from the National Renewable Energy Laboratory and the Electric Power Research Institute, PG&E calculates the need is a level two charging station for every four vehicles.

That comes out to 100,000 charging stations for its territory, resulting in PG&E’s proposed 25,000 stations to meet 25% of that need.

“A 25% market share will not be overbearing to the market because it leaves 75% to the other players,“ Ellis said. “But it will reduce barriers to EV ownership, drive adoption, and raise awareness.”

The 100 DC fast chargers will likely make up no more than 20% of the PG&E territory’s 2020 need, Ellis acknowledged.

“The studies show we will require 500-plus DC fast-chargers," he said. "Some automotive companies are suggesting 1,200-plus fast chargers to make charging more analogous to today’s fueling paradigm,” he said. “We may need more than 100 in the future.”

Deployment of DC fast chargers is more logistically challenging, both Ellis and Friedland said, because of their high impact on the grid.

PG&E will build the level two chargers as quickly as possible to create more convenience and reduce range anxiety for both plug-in hybrid electric vehicle (PHEV) and battery electric vehicle (BEV) drivers, Ellis said. “But where we might have a bank of 10 level two chargers, we might only have one or two DC fast chargers.”

PHEV drivers do not need fast chargers, he added, and “BEV drivers will be able to charge for up to 30 minutes and get enough range to get to the next level two charger.”

The PG&E proposal does not include level one chargers, Ellis said, because they are not likely to cost-effectively support the bigger and more demanding batteries coming from EV makers.

How and why PG&E will build

PG&E will contract with site hosts and provide the EV service connection at no cost through a separate service drop, instead of through existing infrastructure. Its EV service provider partners will deploy and operate the chargers through a competitive bidding procurement but PG&E will own them.

“We will sell electricity to the service provider at an applicable time-of-use commercial rate,“ Ellis said. “They will sell it to customers. But the two rates will be nearly the same, and approved by the CPUC. The billing partner will make money through a services contract with us, not through a significant markup on the price of electricity.”

Putting a price on emissions would be good for utilities because it would drive the uptake of electric vehicles which would in turn boost demand for the electricity that utilities sell, PG&E CEO Tony Earley Jr. told a conference recently.

“If we can get more EV charging and more electricity use through EVs at opportune times, that helps us maintain rates and potentially even puts downward pressure on rates over the long term,” Ellis explained.

Kicker: Renewables integration

A happy side effect of the chargers is that they can also help PG&E integrate more renewables onto the grid.

“We would like to do smart charging and turn those chargers on when we have high renewables, especially solar, on the system,” Ellis said. The TOU rates are intended to drive consumers in that direction and the level two chargers are intended to get the electricity to the vehicles in the targeted time frame.

“It used to be that we wanted to push charging to the night because that was when the power was cheaper and in excess,” Freidland said. “Now, there is a demand for smart charging and demand response. A charger owner might allow the utility to use it during the midday supply peak when renewables are in excess but not during the early evening demand peak. A modification of what Tony Early said is that EV charging will help utilities sell electricity in a smarter way.”